Improving healthcare through education, advocacy, service, and physician well-being

Our mission is improving healthcare through education, advocacy, service, and physician well-being, with a vision of a healthy region with compassionate medical care.

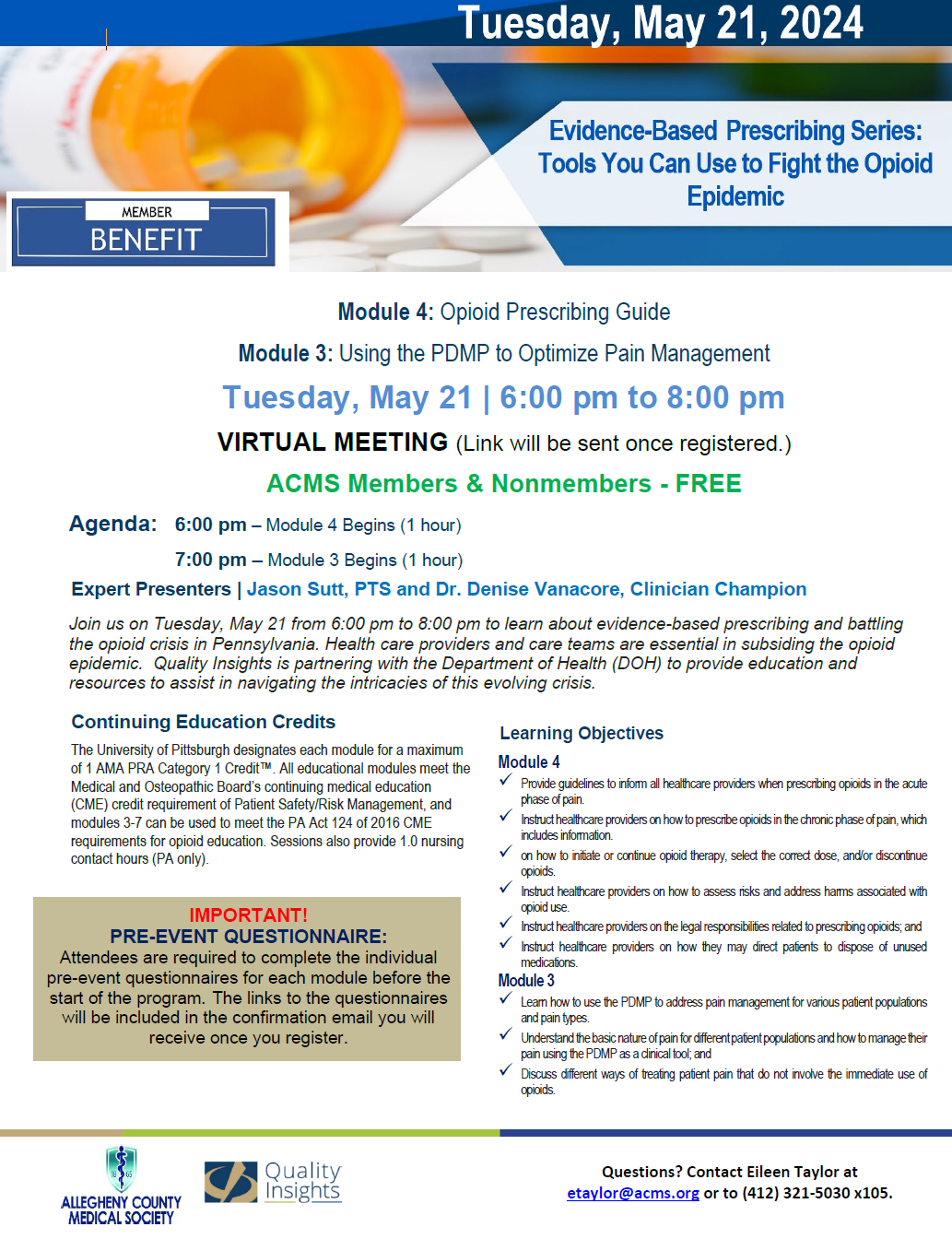

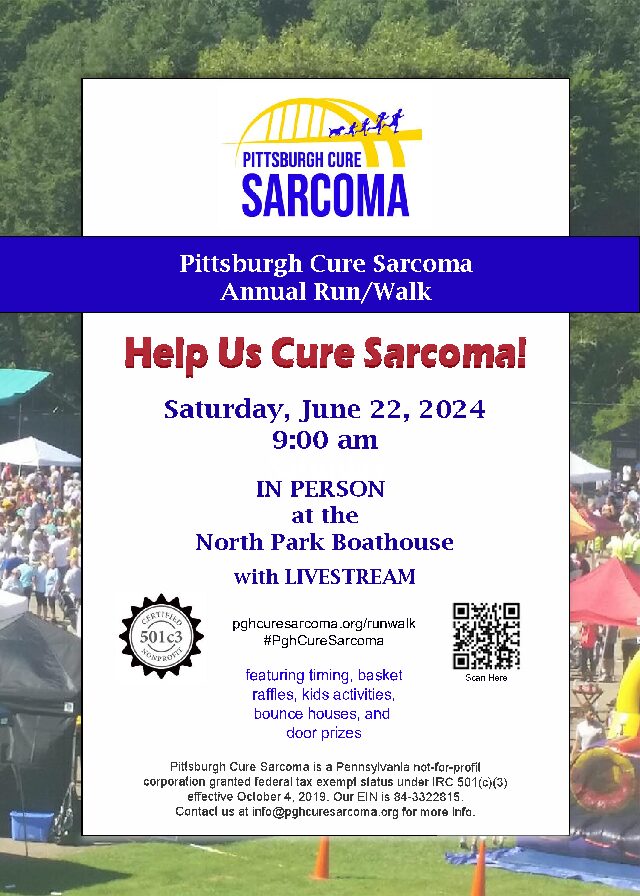

Upcoming Events

Member Benefits

Member Services

Since its inception in 1865, the central role of the Allegheny County Medical Society has been the health and well-being of the community. In addition to individual patient care, medicine has been deeply involved in issues of public health.